How Alternative Investments Can Help with Diversification

First Steps

Source: Jiri Hera/stock.adobe.com

Beyond stocks: Alternative investments in the form of strategic metals are a lesser-known but promising addition to a portfolio. They stand out for maintaining purchasing power and protecting against inflation.

“Never put all your eggs in one basket.” This proverb conveys the fundamental idea of portfolio diversification. In the complex world of investing, diversity is the cornerstone of a sound portfolio strategy. It’s become especially important in recent years as epidemics, wars, and trade disputes roil the financial and economic markets and cause individual asset classes to crash.

Diversification for Financial Stability

By spreading assets across different asset classes, you can reduce the impact of market fluctuations. If there’s weakness in one area, positive results from other areas can offset potential losses. This not only creates stability but also allows investors to benefit from different economic conditions. Harry M. Markowitz, who received the Nobel Prize in Economics in 1990 for his modern portfolio theory, describes the idea behind it as follows:

“A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies.”

It’s not only a matter of quantity, but also of the combination of the portfolio‘s various investments.

Diversification as a Strength: Strategic Metals as Alternative Investments

In addition to established asset classes such as cash, stocks, bonds, gold and real estate, alternative investments are becoming increasingly relevant. These include works of art, vintage cars, whiskey, and strategic commodities. Alternative investments should never dominate a portfolio but only complement existing investments. There are no general guidelines for their weighting in a portfolio because much depends on the investment’s risk propensity and the buyer’s investment goals. In most cases, the typical recommendation is that alternative investments should make up 5-10% of the total investment portfolio.

Strategic metals are some of the most promising additions to a portfolio. Technology metals, rare earths, and platinum group metals play a significant role in modern technologies (including semiconductor technology, renewable energies, and the automotive industry), but they are usually in short supply.

The advantages of adding strategic metals to a portfolio include:

- Supply and demand. Limited availability and growing industrial demand could lead to rising prices. This opens up long-term return opportunities for private buyers.

- Long-term demand. Political and environmental goals such as the European “Green Deal” will drive the demand for strategic metals for many years to come.

- Volatile supply chains. Crisis scenarios and political strategy plays can make global supply routes more complex or cut them off. This can cause large price gains.

- Stability. Raw materials have a physical material value independent of what happens on the stock or currency markets. This makes them less susceptible to crises. It also helps maintain purchasing power and the ability to offset inflation. The type of investment metal, the time of purchase, and the holding period can therefore be decisive factors in determining the profitability and stability of the financial investment.

Diversification also Applies to Alternative Investments

However, simply adding strategic metals to a portfolio is not enough. Private buyers should not focus on just one raw material, but diversify by spreading their money across different metals. For example, they can choose between technology metals such as gallium, germanium, and hafnium, and the rare earths dysprosium, neodymium, praseodymium, and terbium.

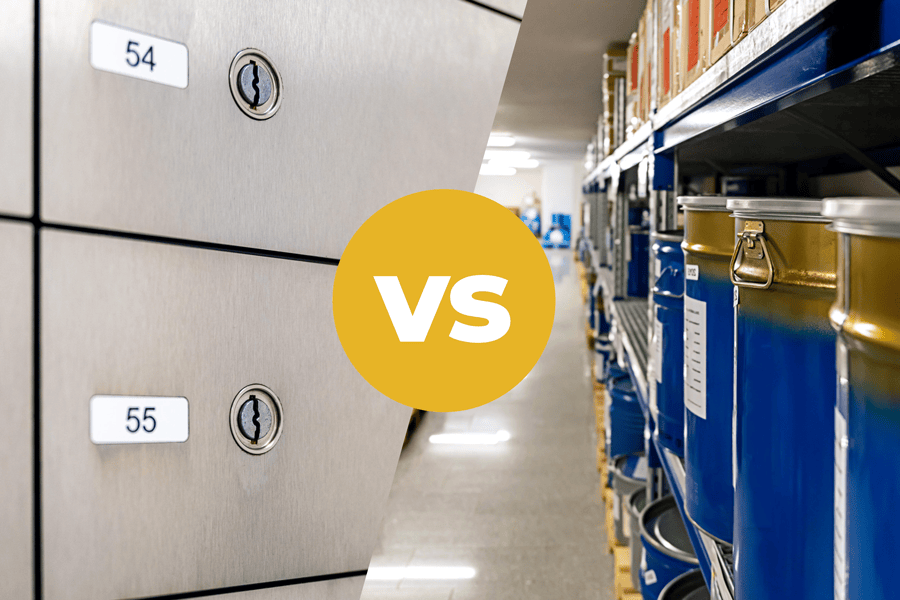

Private buyers who invest in strategic metals purchase the assets in physical form and sell them to the processing industry at a later date. You can learn everything you should look out for when buying investment metals in our blog post Seven Things to Consider When Buying Strategic Metals.