Chinese Export Restrictions Cause Spikes in Technology Metal Prices

October 2023 | News

Since China’s export controls took effect, gallium and germanium exports have come to a standstill. Prices of these raw materials, and indium, have risen in recent weeks.

In July 2023, we reported on China’s planned export controls on the technology metals gallium and germanium. These came into force on August 1, after which date Chinese companies required a license from the Ministry of Commerce to export these two technology metals. The requirements apply to so-called dual-use goods that can be used for both military and civilian purposes – for example, in the manufacturing industry. China says it implemented the new rules for national security reasons.

As a result of the restrictions, export volumes from the People’s Republic fell sharply in August and were at times zero for certain forms of these raw materials. One reason for the shortfalls is likely the long lead time from application to licensing for exports, which can be as long as 60 days. This development led to a shortage in the gallium market at a time of increased demand.

Values of Technology Metals Rise at Different Rates

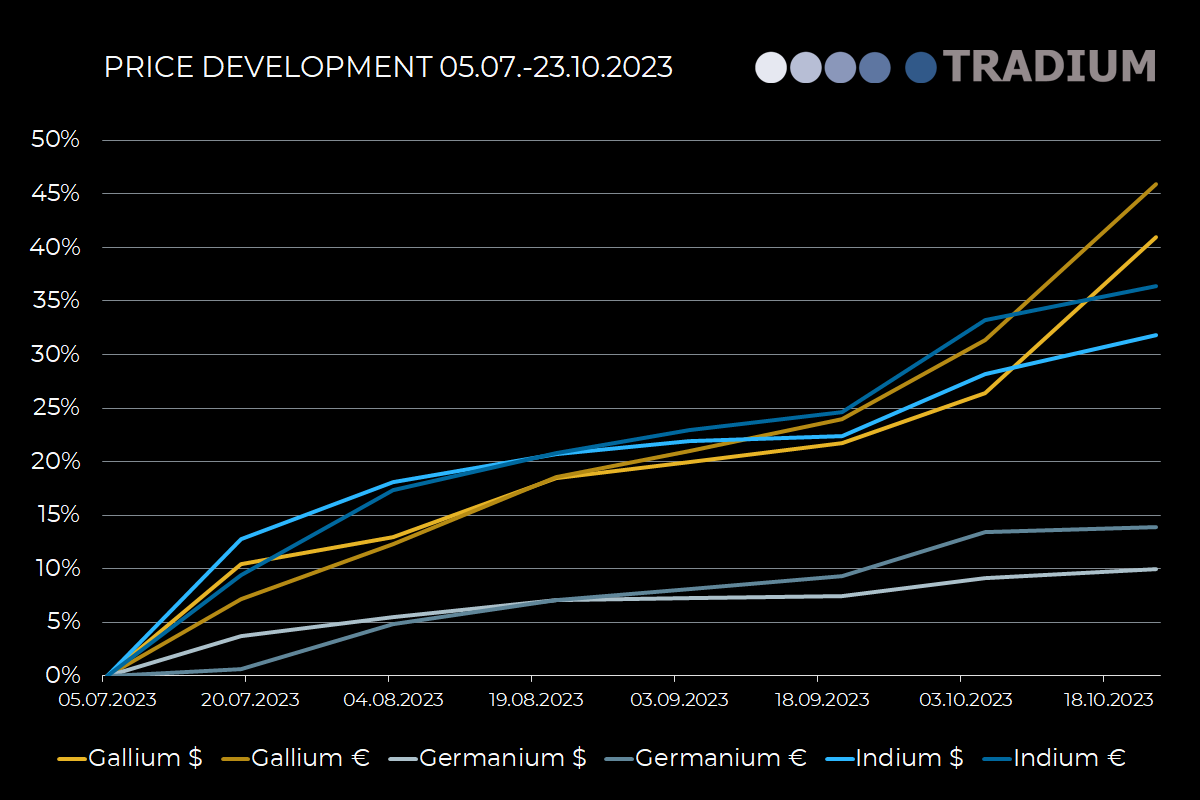

The full extent of the Chinese restrictions remains to be seen due to the long processing times for export applications, but the early effects on commodity trading are already becoming apparent. New information is available for buyers of and those interested in strategic metals as tangible assets. For example, the prices of gallium and germanium rose after the announcement of the export controls in July. Since the export restrictions came into force on August 1, prices of both metals have continued to rise, in some cases by more than 40 percent.

The price of another technology metal, indium, has also risen sharply since July. The biggest price increase among all three metals was recently recorded for gallium, which in October reached its highest value since February after an increase of more than 30 percent. Indium’s price also rose by just under 30 percent. The increase in the value of germanium was at least 9 percent.

“The price increases for metals are only partly the result of an increase in market demand,” explains Matthias Rüth, Managing Director of the raw materials supplier TRADIUM GmbH. “One factor that plays an equally important role is China’s supply difficulties. Chinese companies are hardly able to export, if at all. In the medium term, I expect the raw materials market situation will calm down.”

China Foresees Further Export Restrictions

Industry observers view the export licenses required by the People’s Republic as a response to current U.S. export restrictions on latest-generation semiconductor chips. And the U.S.-China trade dispute seems to be getting worse: last Friday, China announced export controls on another critical resource: graphite, a battery material that’s important for electromobility. Licenses for graphite exports will be required as of December 1, as the industry news service Rawmaterials.net has reported. China is the world’s largest producer of graphite, gallium, and germanium.

According to analysts, however, it’s unclear how great the impact of these new measures will be, Reuters reports. Export restrictions on other raw materials, such as rare earths, are also conceivable.