Rare Earths: China’s Long Road to Success as a Raw Materials Giant

February 2024 | Market Insights

Source: shutterstock/Evgeny_V

The rare earth industry in China has undergone a remarkable transformation from partly unregulated mining of raw materials and countless stakeholders to a highly regulated and manageable industry. This market consolidation was planned for decades.

The raw materials superpower: Rare earths and China are often mentioned in the same breath. The Middle Kingdom possesses the world’s largest known deposits of these critical minerals and has a virtual monopoly on their mining and processing. The Bayan Obo mine in Baotou, Inner Mongolia Autonomous Region, is known as the “world capital of rare earths” — a status that is the result of decades of planning and targeted political decisions.

China’s Nuclear Program and the Domestic Commodities Market

The key to China’s current dominance in rare earths lies in the country’s nuclear program. In the 1950s, important technological foundations were laid for the process, which developed around 20 years later to separate raw rare earth materials. The new method marked a change in the global division of labor. Until then, China had exported its raw materials to other countries for further processing. After introducing the new methods, the old relationship gradually began to reverse. In the mid-1980s, China replaced the U.S. as the world’s largest producer of rare earths. Exports increased, while prices for rare earths dropped due to overcapacity. Between 2002 and 2005, many other suppliers found themselves unable to compete with China’s rare earth supply and pricing, which led to the closure of several mines, including the formerly important Mountain Pass mine in the USA.

However, this increasingly dynamic production growth created a fragmented industry in China with thousands of mines, some of which were illegal, competing fiercely with each other and often circumventing environmental and safety regulations. This situation depressed prices, so the government decided on a far-reaching plan to clean up the market and give it more clout.

Did you know?

At TRADIUM, you can acquire four of the 17 rare earths as tangible assets. You can see the current price trends at any time in our regularly updated price charts for dysprosium, neodymium, praseodymium, and terbium.

Market Consolidation: A Solution for Many Challenges

The State Council of the People’s Republic considered consolidating the solution and approved the corresponding plans in 2002. At the same time, it initiated a reduction in the number of market participants for 14 other resources — antimony, bauxite, lead, iron ore, gold, potassium, coal, copper, manganese, molybdenum, phosphorus, tungsten, zinc, and tin — in addition to the rare earth group.

In the rare earth sector, the reasons for the project were complex. Above all, the Chinese government wanted more control over pricing. Due to the fragmented market, Beijing’s influence in this area was limited despite the country’s international quasi-monopoly of the extraction and processing of critical raw materials. Individual companies sometimes undercut each other. The Chinese Minister of Industry and Information Technology, Xiao Yaqing, was still complaining in 2021 that China was selling rare earths at the price of earths rather than the price of something scarce. Beijing also hoped consolidation would simplify decision-making and enforcement processes in the sector. Growing environmental concerns and a plethora of illegally operating mining companies connected to smuggling activities were cited as additional concerns that consolidation would address. Another factor supporting market concentration was the goal of upgrading quality in the industry. Consolidation would give the government more influence over the industry’s ongoing development and modernization.

Start-up Difficulties in the South, Faster Success in the North

The project, which has been running since 2002, envisaged only two large companies for rare earths in the long term: one in the north and one in the south. This choice was due to natural geographical conditions and the different mining histories in the individual regions. In the north, ores are extracted from open-pit mines that predominantly contain light rare earths. In the south, heavy rare earths are extracted from ion adsorption clays. These clays are formed wherever strong weather conditions prevail. They are currently economically important only in southern China and neighboring Myanmar.

Light rare earths: Scandium, lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium

Heavy rare earths: Yttrium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium

The plan also envisioned a consolidation of the downstream processing industry. In the north, processing companies have settled in the city of Baotou, approximately 150 kilometers away from the world’s most important rare earth deposit, Bayan Obo.

The South was also characterized by a large number of players fighting for market dominance. Due to the large number of companies, the consolidation plans were (unsurprisingly) met with resistance. Pushback also came from provincial governments. They received taxes from locally operating companies, whereas those from centrally managed companies would flow to Beijing. Consolidation progressed far more smoothly in the north, mainly because its mining industry had been far more homogeneous for decades and in the hands of individual large companies.

Evaluation of the situation by Jan Giese, Senior Manager Minor Metals and Rare Earth Elements at TRADIUM

China has long been striving to position itself in all downstream stages of the value chain, moving away from a simple role as the “workbench of the world” to …

Consolidation Continues: Significantly Fewer Licenses, Export Prices Explode

On the surface, consolidation progressed slowly as the government gradually granted fewer mining rights. By 2012, the number of licenses issued had fallen from 113 to 67, with 90 percent of these rights ending up with companies that later became part of China’s six largest rare earth companies, the so-called Big Six. Exports were also concentrated during this time, with the government authorizing only 22 companies to export rare earths in 2011. In 2006, there were 47.

In parallel to the measures in the domestic market, China also sought more control over exports. In 2006, the People’s Republic successfully introduced quotas limiting rare earth export quantities. China gradually tightened these quotas. In 2010, the Chinese customs authority even temporarily halted the export of rare earths to Japan due to a smoldering trade dispute, even though this was never officially confirmed. Fears of a nationwide supply freeze caused rare earth prices on the international market to rise to a level that has yet to be exceeded.

In 2012, the USA, together with the European Union and Japan, filed a complaint with the World Trade Organization (WTO) against a further tightening of export quotas. The reason given was that China was violating applicable law by denying access to critical raw materials. In 2014, the WTO ruled against the People’s Republic, which dropped the export quotas in protest.

An Important Stage: One Large Rare Earth Company in the North, Five in the South

In 2012, the rare earth industry in the autonomous region of Inner Mongolia came under the complete control of a subsidiary of the iron and steel group Baotou Iron and Steel, which has been operating under the name China Northern Rare Earth Group since 2014. After the consolidation of 35 producers, the rare earth industry in China’s north was controlled by one company.

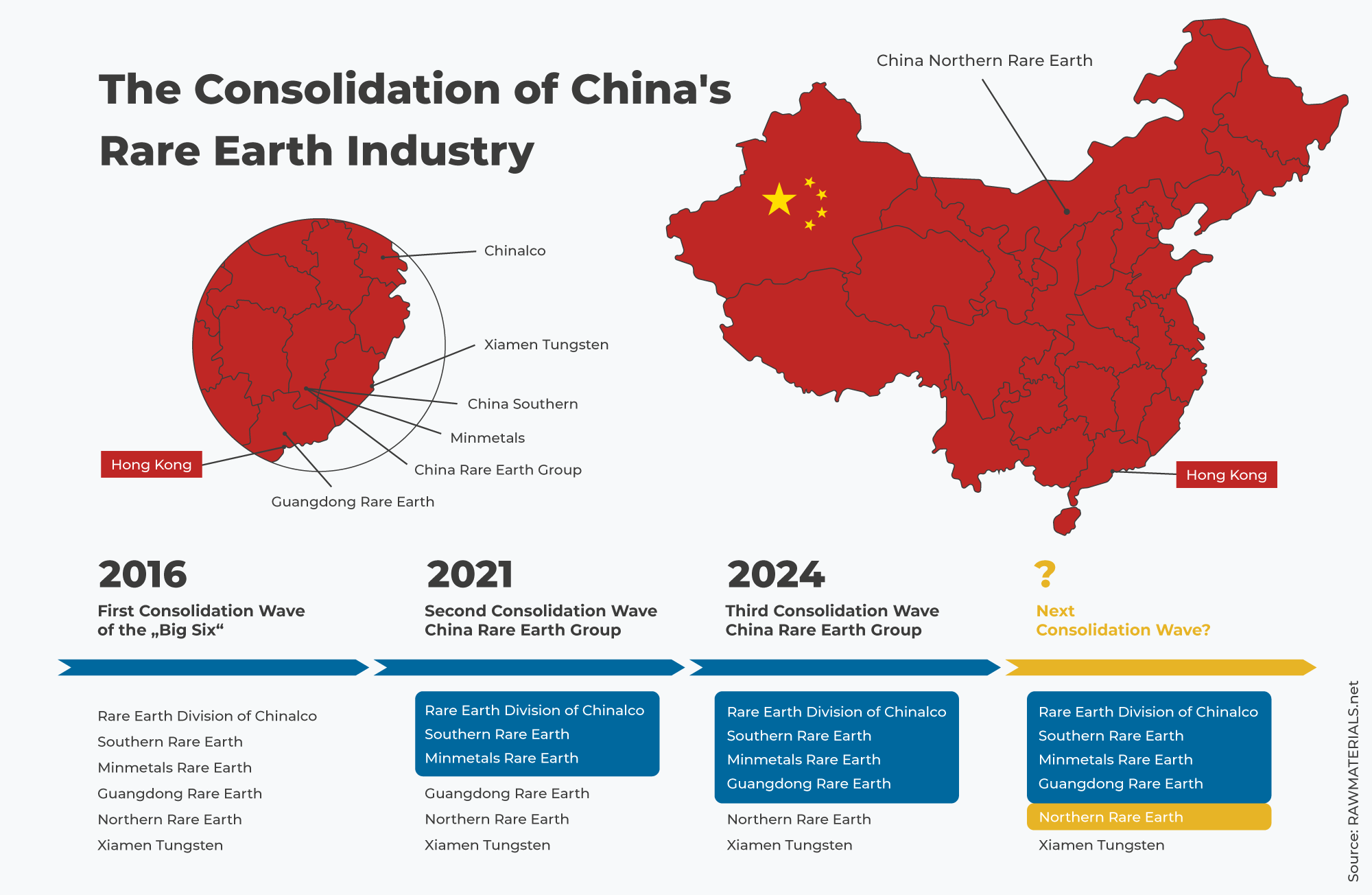

Consolidation also made gradual progress in the south, but it wasn’t until 2016 that the first sustainable centralization was completed. By consolidating hundreds of companies into five — Xiamen Tungsten, Minmetals Rare Earth, Guangdong Rare Earth, the rare earth division of Chinalco (Aluminium Corporation of China), and China Southern Rare Earth — the industry in the south was now also streamlined in organizational terms. By 2016, together with the China Northern Rare Earth Group in the north, China’s entire rare earth sector was in the hands of six large companies, the so-called Big Six.

The Second Rare Earth Giant is Being Built in the South

The next step on the way to creating two market-dominating groups took place in 2021. Three of the Big Six — the rare earth division Chinalcos, Minmetals Rare Earth, and China Southern Rare Earth — merged under the name China Rare Earth Group (CREG). The three companies each held a 20 percent stake in CREG. In addition, the Chinese government held a direct 30% stake in CREG in the form of the State-owned Assets Supervision and Administration Commission. The remaining ten percent was distributed among smaller research companies.

The takeover of Guangdong Rare Earth in 2024 was the last official step for the time being in the streamlining of China’s rare earth industry. This left Xiamen Tungsten as the only independent company. However, Xiamen Tungsten and CREG had been cooperating since 2023 in a joint venture in which CREG held more than 50 percent—the scheme aimed to pool production quotas. The days of Xiamen Tungsten’s independence were, therefore, already numbered.

Beijing published new production quotas in February 2024. Only two companies are still listed: the China Northern Rare Earth Group in the north, which is solely responsible for light rare earths, and the China Rare Earth Group in the south, which is also permitted to mine heavy rare earths. Since Xiamen Tungsten is no longer listed, but since its quotas are combined with CREG, it can be deduced that the consolidation plans have now been implemented.

This marks the end of a project that began over two decades ago.

Evaluation of the situation by Jan Giese, Senior Manager Minor Metals and Rare Earth Elements at TRADIUM

“China has long been striving to position itself in all downstream stages of the value chain, moving away from a simple role as the “workbench of the world” to a driving force in the technology sector. From the outset, Beijing has recognized that access to and control of critical raw materials will be the key to success in many high-tech industries crucial to modern life, such as electric mobility. The advanced consolidation of its rare earth industry players has allowed China to merge economic and political goals.

One example of these combined advantages can be seen in current price trends. The consistent increase in production quotas has caused rare earths prices in China to fall sharply in recent months. Although this often leads to losses for manufacturing companies, the downstream processes in the Chinese value chain are benefiting from the low prices. This is another reason why they can offer low-cost products such as electric cars. At the same time, prices have settled at a level that makes production outside China simply unprofitable. China takes a long-term and strategic view of these markets: short-term losses in raw material production are therefore accepted, as they strengthen the competitiveness and dominance of the overall value chain in the long term. “

Further reading:

Julie Michelle Klinger: Rare Earth Frontiers, Cornell University Press 2017

Congressional Research Service: China’s Rare Earth Industry and Export Regime: Economic and Trade Implications for the United States, 2012.

“China denies banning rare earths exports to Japan”, 23.09.2010, Reuters.com.

Shen, Lei & Na, Wu & Zhong, Shuai & Gao, Li. (2017). Overview on China’s Rare Earth Industry Restructuring and Regulation Reforms. Journal of Resources and Ecology. 8. 213-222. 10.5814/j.issn.1674-764x.2017.03.001.

Federal Academy for Security Policy | Security Policy Working Paper No. 13/2019

“China’s rare-earth giants forming ‘super group’ in merger for high-quality devt, deal with price abnormalities”, 24.10.2021, globaltimes.cn.

The White House: Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth, 2021.