Gallium and Germanium: New Export Figures Confirm Turbulent Year 2023

January 2024 | Marktet Insights

Source: iStock/DINphotogallery

Chinese export restrictions that took effect last August created a challenging market for gallium and germanium in the latter months of 2023. Export figures and price movement since then have underscored the effects of the new rules.

In 2023, China’s influence on the raw materials market was particularly evident in the case of gallium and germanium. The People’s Republic, the largest producer of these two technology metals, introduced export restrictions that had a tangible impact on the exports and prices of the metals. *

The export controls on gallium and germanium were announced in July 2023 and came into force in August. Since then, Chinese companies have required a license from the Ministry of Commerce to export the metals. The requirement pertains to dual-use goods that can be used for both military and civilian purposes. The measures were justified on the grounds of China’s national security.

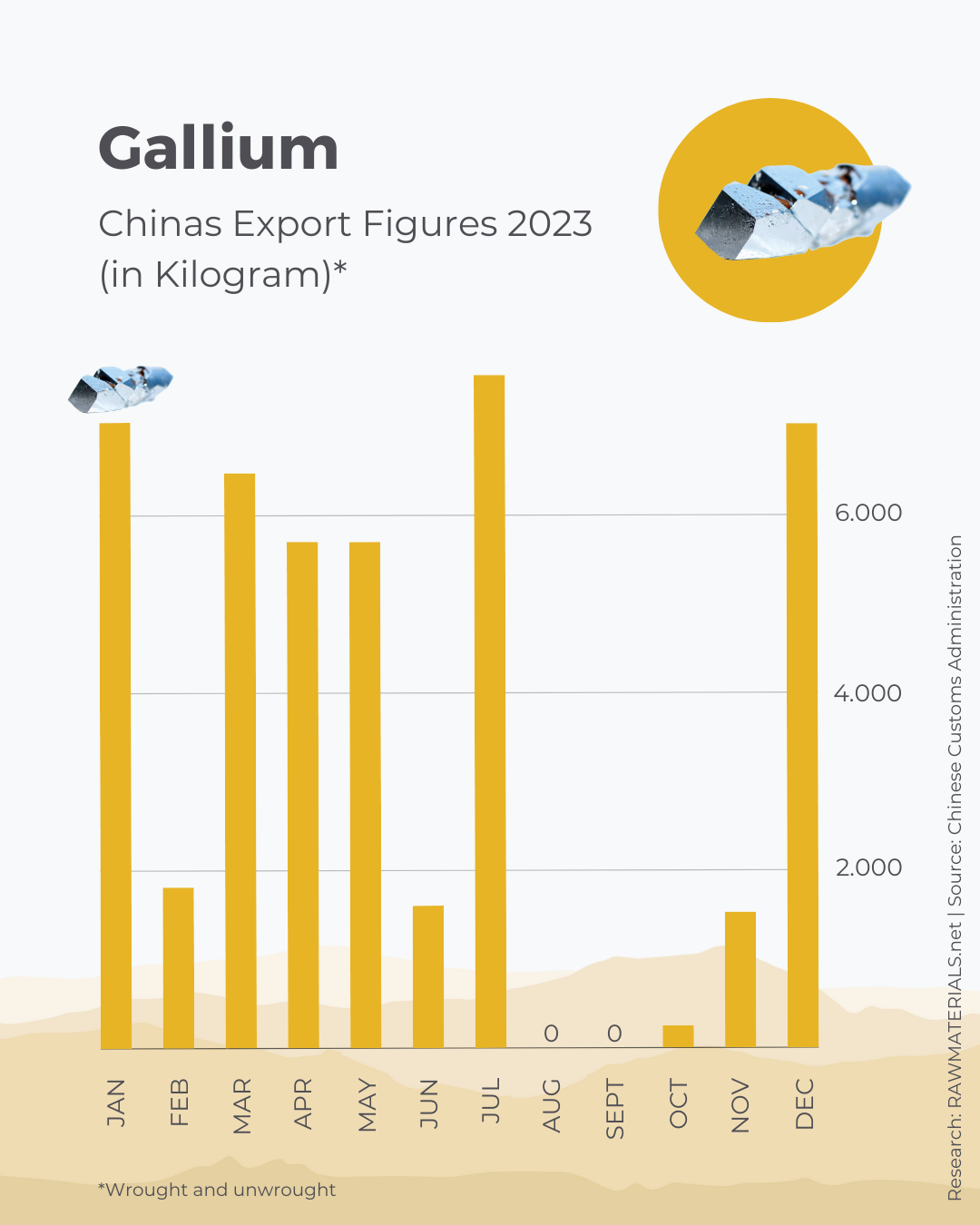

Gallium: Export Restrictions Put an End to the Slump

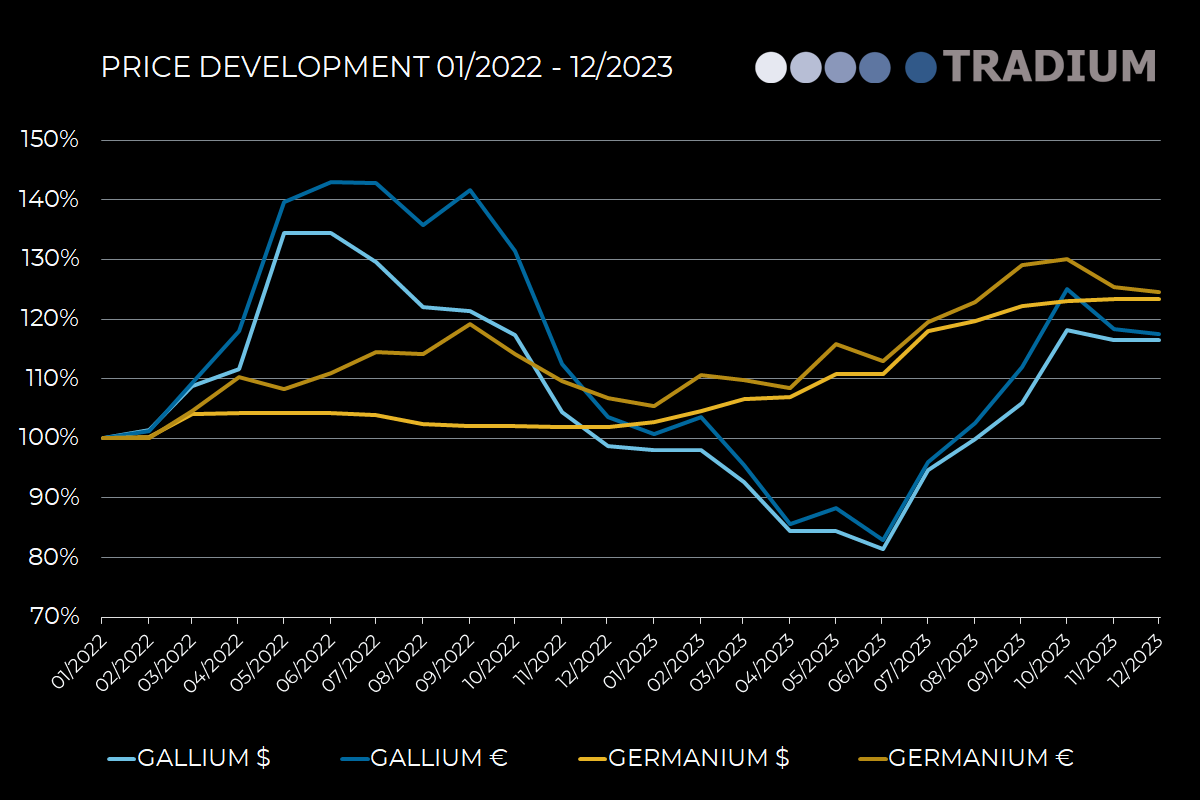

The export restrictions caused movement in the markets. The price of gallium saw a predominantly downward trend until the middle of the year. The direction changed abruptly when the export restrictions were announced in July. Prices rose until October, when they reached their peak for the year. Exports initially came to a standstill after the export restrictions took effect due to long processing times for export licenses. Processing companies without stock had to rely on just-in-time deliveries and had to overcome major difficulties. To maintain the supply of raw materials and avoid bottlenecks, these companies had to find alternative sources of supply on short notice. From October onwards, exports of gallium slowly resumed, and prices fell again slightly. In December, prices exceeded the levels seen in December 2022.

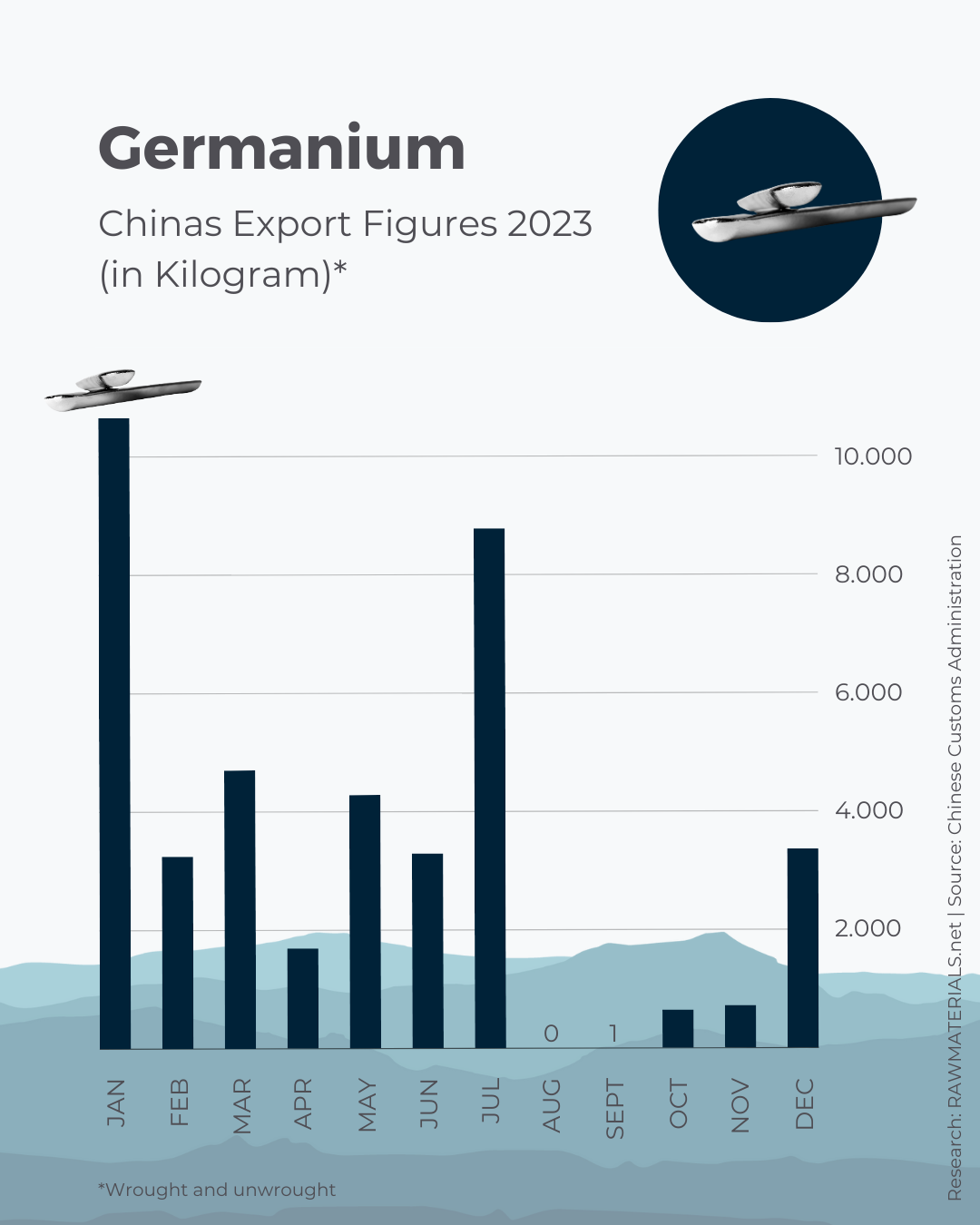

Germanium: Prices Rise, Export Figures Fluctuate

The story of germanium exports and prices is similar to that of gallium. Here too, an upward price spike was observed in July, accompanied by a sharp rise in export volumes. Prices continued to rise in the next two months as exports collapsed. Germanium finally reached its price high in November and maintained it in December. As a result, its price rose well above the previous year’s level. At the same time, the market slowly began to recover and export figures increased once again.

What Do Current Market Developments Mean for 2024?

In light of the drop in export volumes in recent months, management consultants Deloitte are forecasting bottlenecks in the supply of the two technology metals in 2024. The limited or delayed exports of raw materials will be accompanied by rising demand. For example, according to the German Mineral Resources Agency, demand for gallium for microchips could more than double in the coming years, increasing from 38 tons in 2018 to up to 79 tons in 2040 (document only available in German). Gallium could also be in greater demand in the renewable energy and LED technology sectors in the future. Demand for germanium for fiberoptic cables is expected to increase from 59 tons in 2018 to as much as 246 tons in 2040. The rising demand for gallium and germanium could also influence future price trends. You can find out how these are developing at any time from our regularly updated price charts.

* In this article, we refer to the development of gallium and germanium prices in US dollars, the leading international currency on the commodities markets.