Strategic Metals as an Alternative to Gold and Silver

First Steps

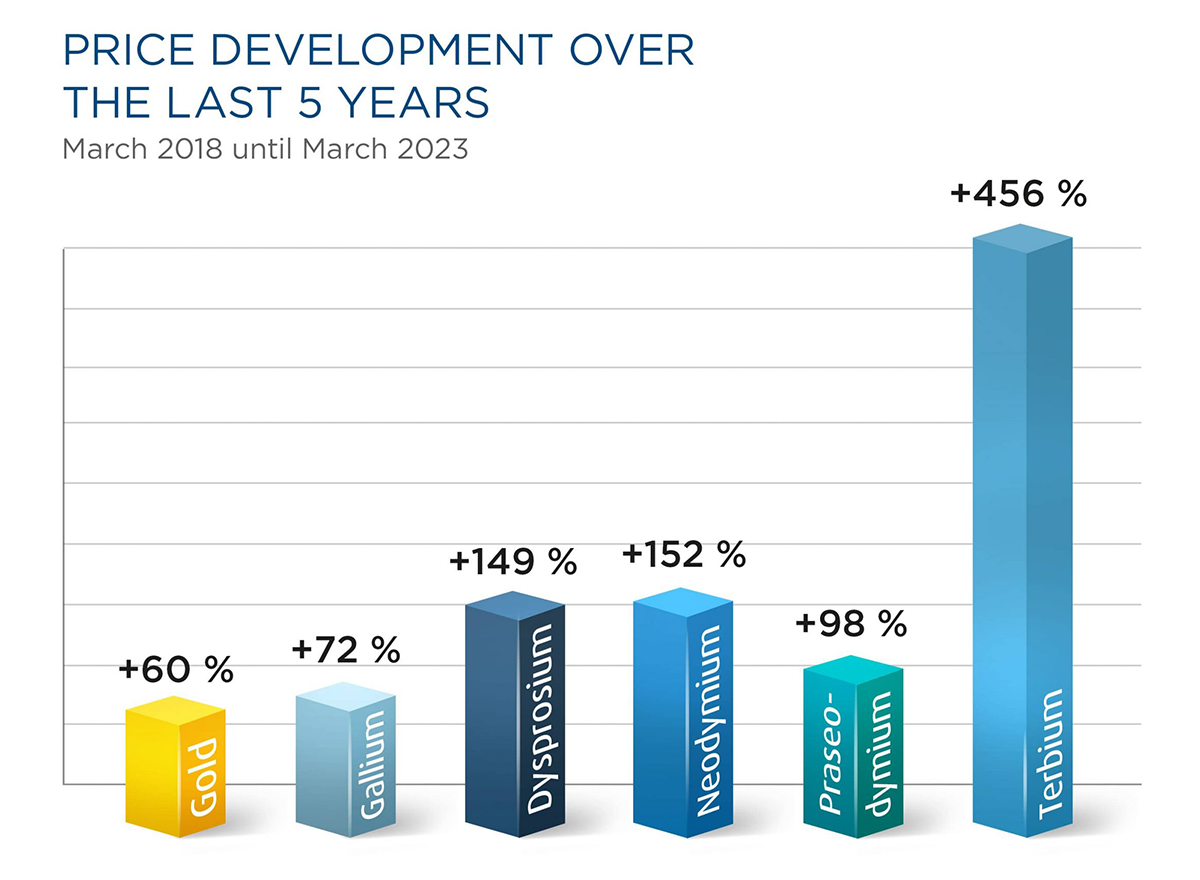

Source: TRADIUM GmbH

Gold and silver are particularly popular as investments. but investors can also buy strategic metals as physical assets.

Gold and silver are among the classic physical assets. They are convincing as a stable, crisis-proof, and inflation-proof investment. Unlike real estate, they can be purchased for smaller amounts. Technology metals and rare earths, so-called strategic metals needed by industry, are becoming genuine competitors. Without them, no key modern technology – from smartphones to electric cars and wind turbines – would exist. Thus, these critical industrial metals are suitable alternative investments to traditional gold and silver.

It Doesn’t Always Have to Be Gold

Compared to gold and silver, strategic metals are a largely unknown investment type. Few people have heard of gallium, hafnium, neodymium or terbium. The names of individual technology metals and rare earth elements usually only pop up in business circles. But it is worthwhile to know these raw materials in private life as well, as they’re in no way inferior to gold and silver in their properties as investment metals.

These five reasons show why a portfolio of physical assets doesn’t always have to be based on gold:

Quelle: Heraeus, TRADIUM

- What is rare is valuable: gold is a scarce resource, with an annual production of 3,500 tons. But some strategic metals are even scarcer. A maximum of only 80 tons of the technology metal hafnium are mined each year. The global production capacity of gallium is currently around 700 tons per year.

- Rising demand: global demand for gold reached a record level in 2022, growing by 18%, according to the World Gold Council. Demand for rare earths is expected to increase by more than 40% by 2030, reports German WirtschaftsWoche. An important driver of this development is the production of rare earth magnets, which are installed in wind turbines and electric vehicles.

- Interesting return opportunities: gold has increased in value by 60% over the past five years. The technology metal gallium has increased by more than 72%, and the rare earth element terbium by a remarkable 456%.

- Easy access: just as it is wise to buy gold and silver from a professional dealer, it is best to turn to a specialized supplier when buying strategic metals. This supplier can offer raw materials of industrial quality. This is an important prerequisite for subsequent resale to the industry. In recent years, this access has become increasingly easy for private buyers. Nevertheless, there are a few things to keep in mind. We have summarized the most important points in our blog post Seven Things to Consider When Buying Strategic Metals.

- Tax exemption: profits from the sale of gold, silver, technology metals, and rare earths are treated equally for tax purposes. Those who sell their investment metals after twelve months at the earliest are exempt from capital gains tax. You can find out more about this in our guide Strategic Metals: Tax Benefits through Duty-Free Storage.

Make a Well-informed Decision on Investment Metals

For investors who have added gold and silver to their portfolio, strategic commodities offer further diversification opportunities. Like classic investment metals, technology metals and rare earths can offer bright prospects. However, neither gold nor strategic raw materials can be reliably predicted to perform well. Therefore, the decision to include strategic metals as an alternative physical asset always requires sound advice. Only then can you make a well-informed choice.