Raw Materials Market for Rare Earths Sends Confusing Signals

March 2023 | Market Insights

Source: iStock/qwerty01

The market for rare earths is on the move. While the energy transition is increasing the demand for these critical raw materials, China, their most important producer, is restricting exports. Against this background, the prices for rare earths have fallen in recent weeks, defying traditional market logic. In an interview, raw materials experts Frank Meier and Jan Giese from TRADIUM assesses the current situation.

How does the supply situation look in the raw materials market for rare earths?

Frank Meier: Rare earths are usually mentioned in the same breath as China. The country is the most important player in the market. Not only does it have extensive deposits, but it also leads the world in the processing of the ores. More than 90% of all rare earths processed – for example, permanent magnets for electric cars or wind turbines – come from China. Countries like the USA, which also mines rare earths, process their raw materials in China. So, the raw materials market for rare earths is firmly in Chinese hands. A few large companies in China, which are subject to government influence and annual production quotas, hold a monopoly. It is therefore unsurprising that reports of raw material discoveries in Europe are attracting a great deal of attention. In January 2023, both light and heavy rare earths were found in Kiruna, Sweden. The latter are very rare in the global distribution. But before the first rare earths can be mined and processed in Sweden, at least ten to fifteen years of planning will pass. A short-term effect on the supply of raw materials is not to be expected.

Rare earths are not traded on commodity exchanges. How does price formation take place?

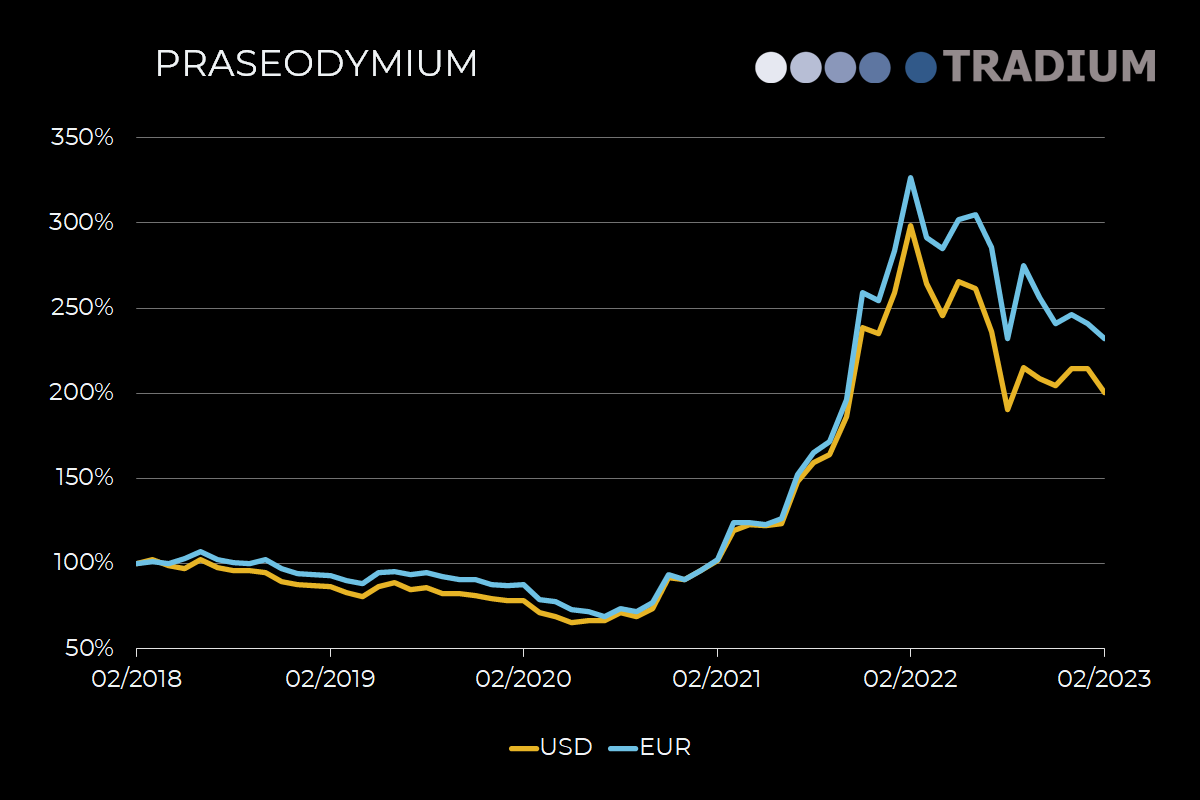

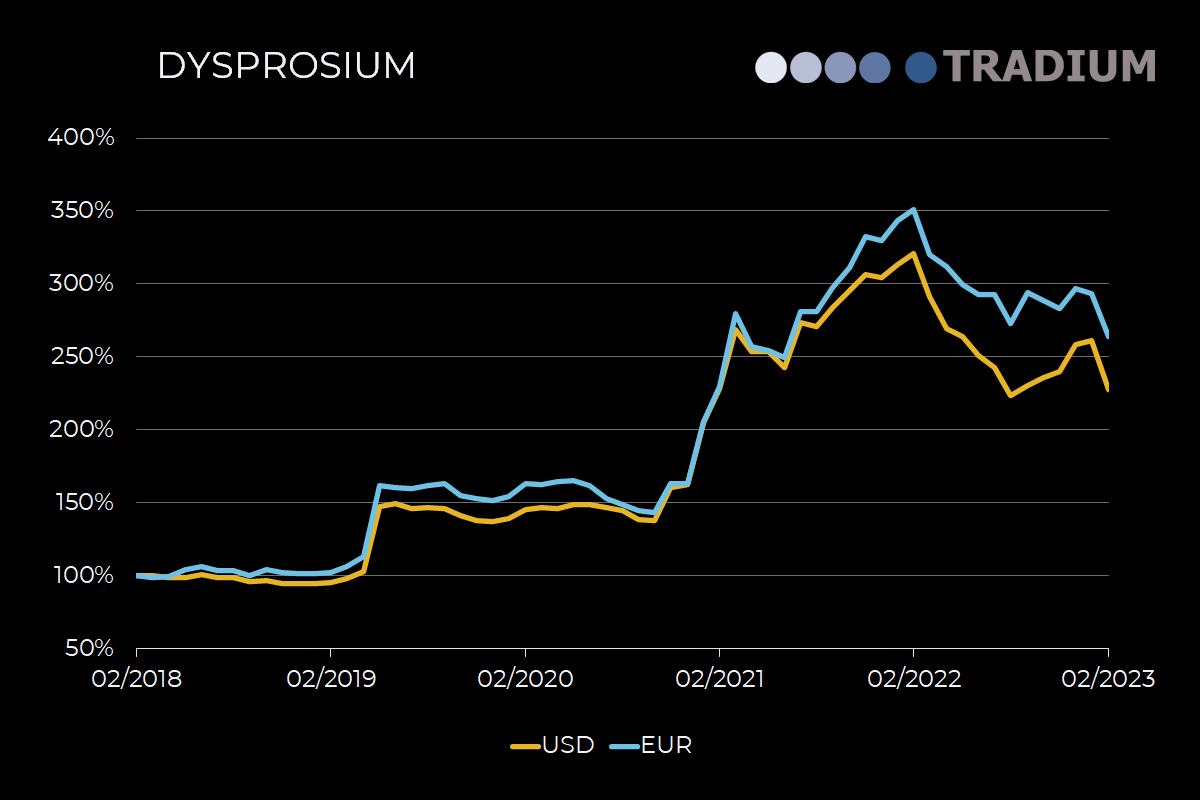

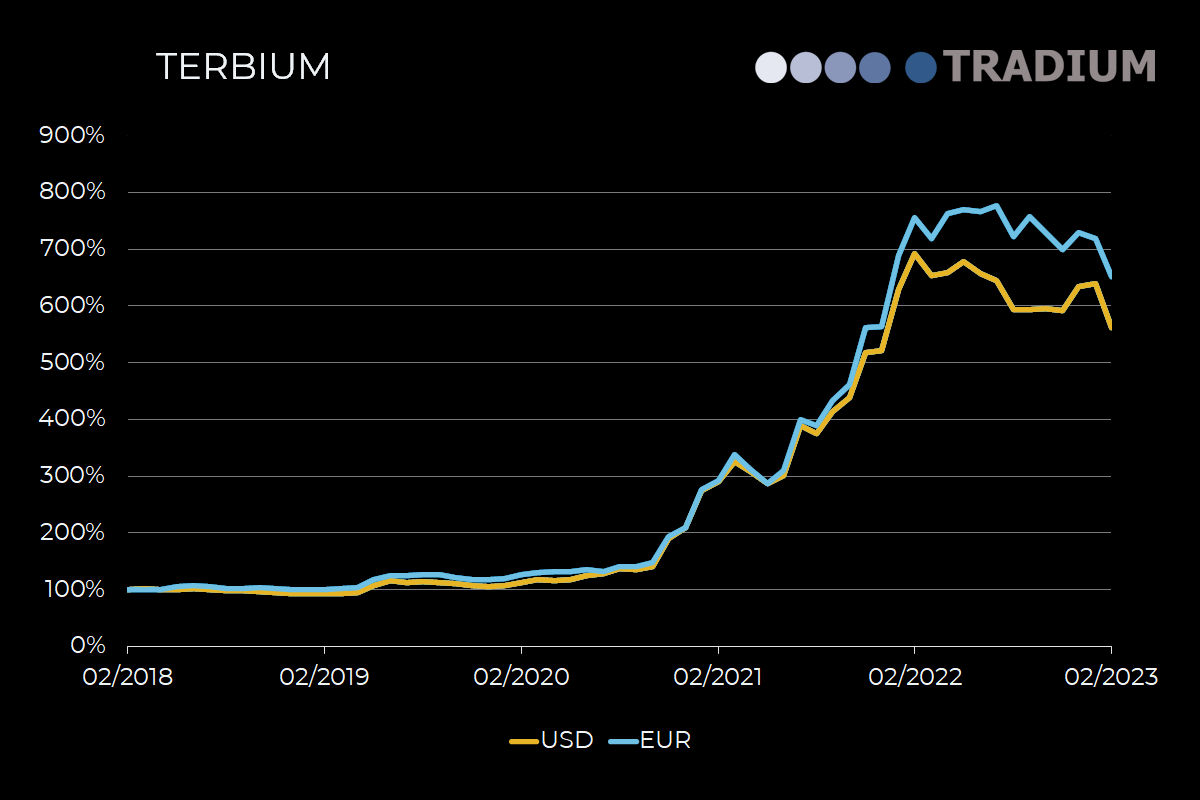

Frank Meier: The raw materials are traded in direct transactions between producers and buyers. Both parties mutually agree on the price, depending on the product quality, the quantity purchased, and the timing. There is therefore no exchange price, as is common in the trade of other metals such as aluminum. In addition, the market for rare earths has its own pattern. Based on our many years of market observations, we know the price tends to be weaker at the beginning of the year. Work at Chinese mines and processing plants is at a standstill during that time because of the Chinese New Year holiday. In addition, producers are waiting for the annual mining and processing quotas, which the Chinese government publishes in March at the latest. They usually have a decisive influence on the supply of raw materials.

The demand for rare earths has increased every year. Shouldn’t that guarantee high raw material prices?

Jan Giese: In recent years, the demand for rare earths has been slightly higher than the supply, which has led to price increases. Currently, however, we see that part of the demand has collapsed due to unmet demand expectations in e-mobility. In numerous countries such as Germany and China, subsidies for these vehicles have expired or been scaled back, which is reflected in falling sales figures. In addition, the industry has to contend with numerous problems ranging from high electricity prices to infrastructure, which still needs to be expanded, as well as insurance issues. Tesla’s mere announcement to substitute rare earths for ferrites in the permanent magnets of its cars has caused additional tremors in the market, although industry observers speak of an overreaction In other applications, such as the expansion of wind energy/renewable energy sources, electrical engineering and the semiconductor industry, the chemical and glass industry, and polishing agents, demand for rare earths is developing as forecast.

Despite the current price correction for rare earths, raw material prices are still very high. How could the market develop in the future?

Jan Giese: Industry experts agree that a supply gap will arise in the long term. The background to this is the global energy transition away from fossil fuels, which the international community agreed to in the Paris Agreement in 2015. The resulting hunger for raw materials is enormous. It could rise from 131,500 metric tons in 2020 to 188,300 metric tons in 2030, just to meet climate targets in the areas of wind power and e-mobility. In the medium term, therefore, there is much to suggest that the prices of the raw materials required for these uses could rise.

Vita:

Frank Meier has been in charge of the Technology Metals and Rare Earths division at TRADIUM since 2019. He has more than 30 years of experience in the raw materials market. Among other things, he gained this expertise working at Heraeus on thin-film technology. He has also been involved in Heraeus’ entry into the production of photovoltaic modules as a product manager and sales representative.

Jan Giese has been working in industrial sales for technology metals and rare earths at TRADIUM since 2022. Before that, the business administration graduate headed global purchasing at Heraeus Quarzglas GmbH, a business unit of the global family-owned company Heraeus, for 2.5 years.