Inflation Hedging through Physical Assets

First Steps

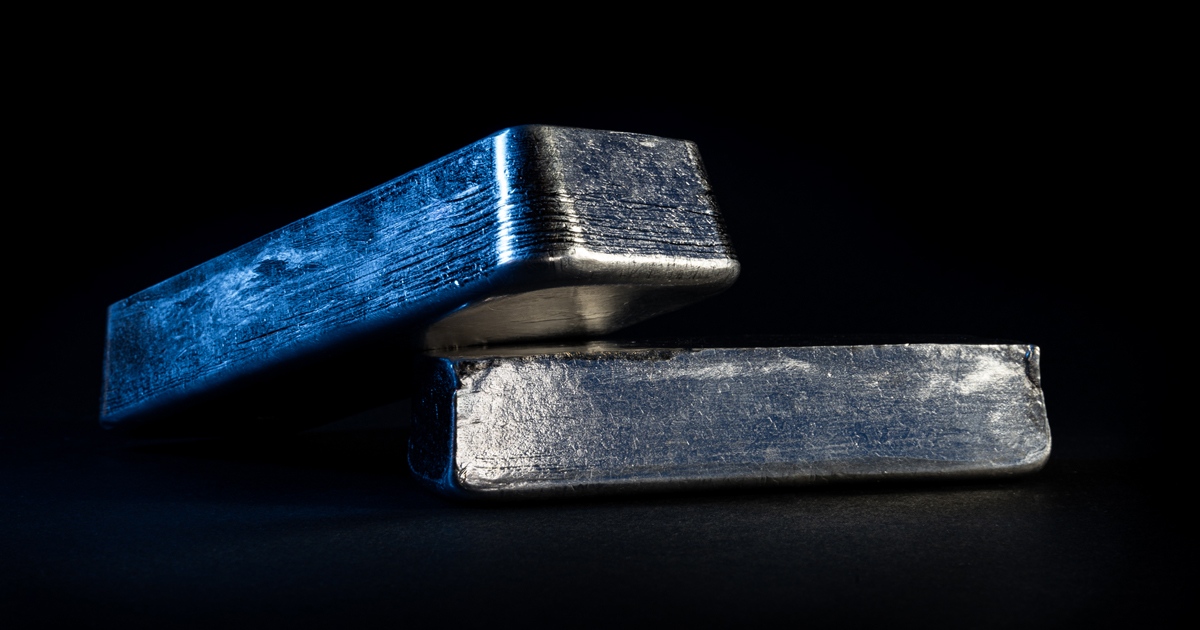

Individuals can use strategic metals as physical assets to focus on long-term value growth and protect their investments against inflation.

10.1% in August, 10.9% in September, and 11.5% in October 2022 – persistently high inflation rates in European Union countries are stoking fears among many people that they will lose their savings. Assets invested in bank accounts or savings books have been subject to creeping devaluation for months. Even the monetary policy measures of the ECB and the FED, such as interest rate hikes, cannot compensate for this, given that the real interest rate remains negative. Still, investors have options to counteract and compensate for the loss of purchasing power.

CEO of Tesla and Germany’s Finance Minister Advise Physical Assets

In times of high inflation rates and uncertain economic prospects, investing part of one’s savings in physical assets might make sense. Elon Musk, CEO of Tesla and multi-billionaire, advises in a tweet to opt for phyiscal assets over cash: “As a general principle … it is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high.”

German Finance Minister Christian Lindner also encourages savers to own physical assets. In a press interview (in German only), he stated: “I am not an investment advisor. But it’s clear that physical assets are better than money in savings or cash when prices are rising.”

Physical assets can be added to any investor’s portfolio for diversification. Private buyers who diversify spread their return opportunities across several types of assets that perform differently under the same market conditions, balancing out losses as in the case of high inflation.

Balancing Inflation with Raw Materials

To protect savings, the portfolio should therefore include forms of investment whose returns or appreciation in value are higher than inflation rates. This is the case, for example, with physical assets, which include not only real estate, artworks and company shares in the form of stocks, but also precious metals and raw materials. The latter two have their own intrinsic value, which never quite falls to zero. Unlike real estate, indiviuals can acquire commodities for a manageable amount. Moreover, there is no cluster risk. Moreover, there is no cluster risk. This is why the German financial journalist Hermann Kutzer, in one of his weekly columns, calls commodities “an archetype of physical assets” and speaks of their renaissance in the investment sector: “Because they are needed everywhere, but at the same time, they are becoming scarcer and more expensive.” Unlike cash, commodities are constantly rising in value.

To demonstrate, the Bloomberg Commodity Index, which tracks various commodity groups such as energy sources, agricultural commodities and industrial metals, has risen by over 18 percent since the beginning of the year. In its monthly reports, the German Raw Materials Agency shows an average price increase of 17 percent for selected metals used in steel refining this year. If we break the analysis down to the level of individual metals, it becomes even clearer that the value increases are far over current inflation rates.

• The rare earth element terbium is essential in fuel cell technology and its price has increased by 58% over the last 12 months.

• Hafnium, a technology metal, is used in everything from superalloys to high-performance computer chips and has increased in price by 97% in one year.

Source: Kai Wipperfürth / TRADIUM GmbH

Providing Access to Industrial Commodities for Individuals

Although the sample commodities are industrial, private customers can also purchase them and speculate on return opportunities. The range of industrial metals for private purchase has become very diverse in recent years. It now includes technology metals, rare earths and precious metals incl. platinum group metals. Before investors acquire these as physical assets, they should inform themselves well and buy from reputable suppliers. After all, there are many aspects to consider, from packaging to industrial quality to resale opportunities. Our blog article, Seven Things to Consider When Buying Strategic Metals, describes in depth what details matter.

Source: Kai Wipperfürth / TRADIUM GmbH