Where is the Price Journey for Hafnium Heading?

February 2023 | Market Insights

Source: Adobe Stock/frank peters

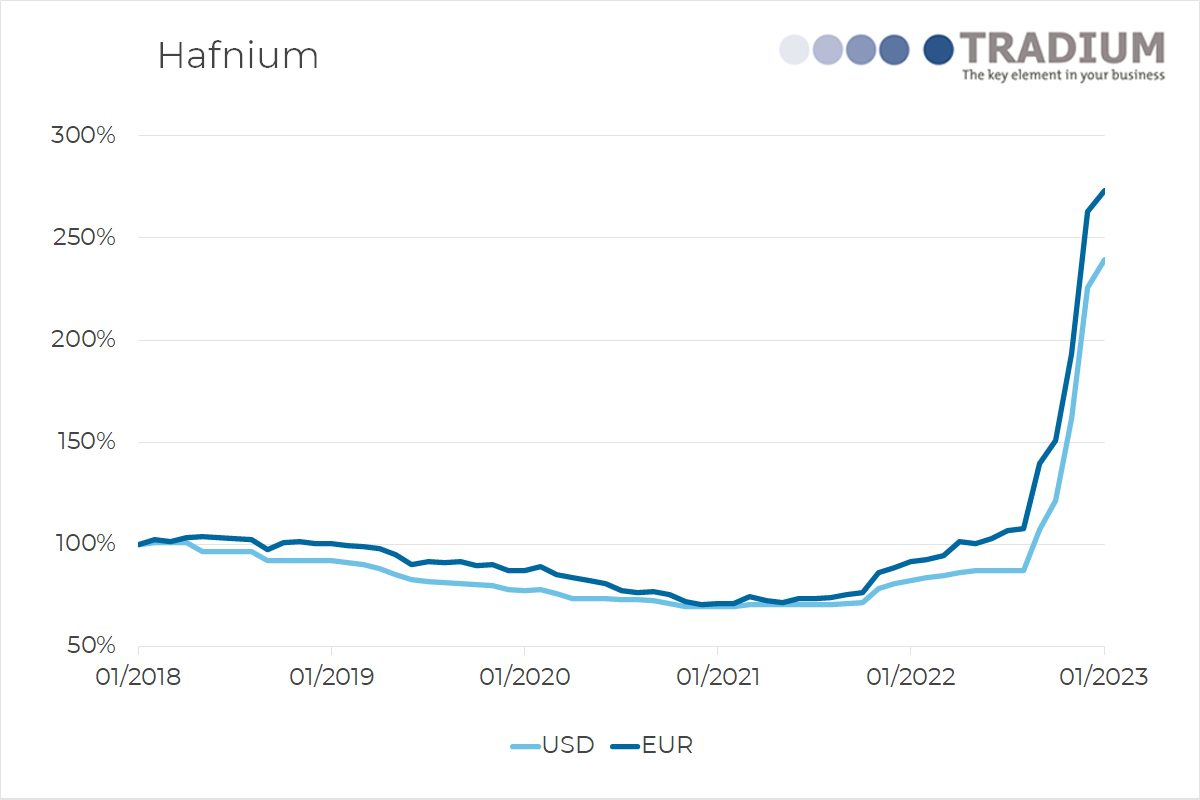

The price increase for hafnium in recent months has been extraordinary. But can the record level be maintained? In an interview, TRADIUM commodity experts Jan Giese and Frank Meier talk about the exceptional development of the commodity market and what consequences the price rally has.

The price of hafnium has risen enormously since the beginning of 2022. For example, the price jump from January to December was 111%. No other strategic metal has experienced such a development in the past year.

What are the reasons for the remarkable price development of hafnium?

Jan Giese: The market for hafnium was well-balanced in the past. The annual production of 75 tons covered the needs of the two relevant applications, namely alloy in the aircraft industry and control rods in the nuclear industry. The balance meant that there was little movement in the market. During the Corona pandemic, air traffic collapsed and also affected the manufacturers of airplanes. Oversupply occurred; less raw material was consumed than produced. In the meantime, however, the market has turned around. Air traffic is picking up significantly, and aircraft manufacturers are reporting full order books. In addition, new nuclear reactors are being planned worldwide. Demand from both industries is significantly higher than before Corona, and raw material stocks are correspondingly empty. Additional demand is coming from the semiconductor industry, which needs hafnium for the production of ever faster and smaller computer chips. Here, too, the trend is strongly upward.

How can producers supply the growing demand?

Frank Meier: In its raw form, hafnium is a byproduct of zircon production, which is also a strategic metal. It is extracted at a ratio of about 1:50. So for every ton of hafnium, 50 tons of zirconium are needed. Despite high prices, producers, therefore, have little interest in increasing hafnium production, as they would also have to extract a large amount of zirconium at the same time. Buyers for additional zirconium are not easy to be found. Producers would therefore produce in stockpiles. As a result, the supply side is not very flexible, and demand from the semiconductor, aircraft, and nuclear industries has risen sharply.

Jan Giese: A lot depends on the extent to which industrial consumers have already stocked up on hafnium. Despite rising prices, many customers are trying to procure as much material as possible in order to be able to meet their future delivery obligations. This reaction often leads to shortages being exacerbated in the short term. As a result, prices rise even further. However, when the supply side recovers and no buyers can be found for the material, the effect can be reversed.

Is it possible to predict an easing in the commodity market?

Frank Meier: According to what we hear from various market participants, not all of them have covered their future needs yet, but want to wait out the current “price storm.” However, if the market does not calm down, they may have to accept even higher prices. This could further fuel the price rally. The market is not only small but also intransparent, making developments difficult to predict. Let’s take the semiconductor industry, whose products are built into electric cars, as an example. In Germany, the number of new registrations for electric cars has been declining since the beginning of the year. If this trend continues, it will depress demand for computer chips and thus also for hafnium.

What can private buyers take away from this situation?

Jan Giese: The smaller a commodity market is, the greater volatility can be. Supply and demand are just one of many drivers of development. . Economic and political factors can also give impetus to the market. These include broken supply chains due to Covid-19 as well as closed mines as a result of strikes or even wars. The US dollar can also play a role. Therefore, one should always remember that every raw material is different, driven, and influenced by different factors. That is why it is important to be well-informed as a private buyer.

Vita:

Jan Giese has been working in industrial sales for technology metals and rare earths at TRADIUM since 2022. Before that, the business administration graduate headed global purchasing at Heraeus Quarzglas GmbH, a business unit of the global family-owned company Heraeus, for 2.5 years.

Frank Meier has been in charge of the Technology Metals and Rare Earths division at TRADIUM since 2019. He has more than 30 years of experience in the raw materials market. Among other things, he gained this at Heraeus in thin-film technology. In addition, he has been involved in Heraeus’ entry into the production of photovoltaic modules as a product manager and sales representative from the beginning.